.svg)

.jpg)

The European digital environment is preparing for a major change. By December 2026, the full rollout of the EU Digital Identity (EUDI) Wallet will fundamentally change how businesses verify customers across the continent. This isn't just another regulatory update to gloss over; it marks a transition from fragmented, manual identity checks to a unified, digital-first ecosystem available to over 450 million people.

At the heart of this new system lies a crucial acronym: Person Identification Data (PID)

For financial institutions, fintechs, and regulated industries, understanding Person Identification Data (PID) is no longer optional. It is the backbone of the new wallet ecosystem. As we have entered the first month of 2026, preparing KYC processes for PID integration is the only way to avoid compliance gaps and operational bottlenecks.

This guide will demystify PID, explain its role within the EUDI Wallet, and explore how it will revolutionize KYC workflows in the coming years.

Before dissecting PID, we must understand the container it lives in. The EU Digital Identity Wallet is a secure mobile application that will allow European citizens and residents to store and share digital identity data and official documents.

The initiative is driven by the eIDAS 2.0 regulation, which provides the legal framework for cross-border digital transactions. While the original eIDAS regulation focused largely on electronic signatures, version 2.0 expands the scope to create a universally accepted digital ID.

The timeline is aggressive. By 2026, large platforms and regulated sectors (such as banking and telecommunications) will be required to accept the wallet for authentication. This means if a user wants to open a bank account in France using a digital wallet issued in Germany, the French bank must be technically ready to accept it.

What is PID?

Person Identification Data (PID) is the core digital identity credential within the European Digital Identity (EUDI) Wallet. It is the digital equivalent of your national ID card or passport’s bio-data page.

While your wallet can hold many "vouching" documents (like a gym pass or a diploma), the PID is the only foundational credential. It is issued exclusively by a Member State or a state-authorized provider, ensuring the highest level of assurance (LoA High). It proves that you are who you say you are in the eyes of the law.

The Technical Backbone: Two Formats

To ensure your ID works everywhere from an offline police check in a rural area to an online bank registration the EUDI Wallet issues PID in two technical formats:

PID Attributes: What Data is Shared?

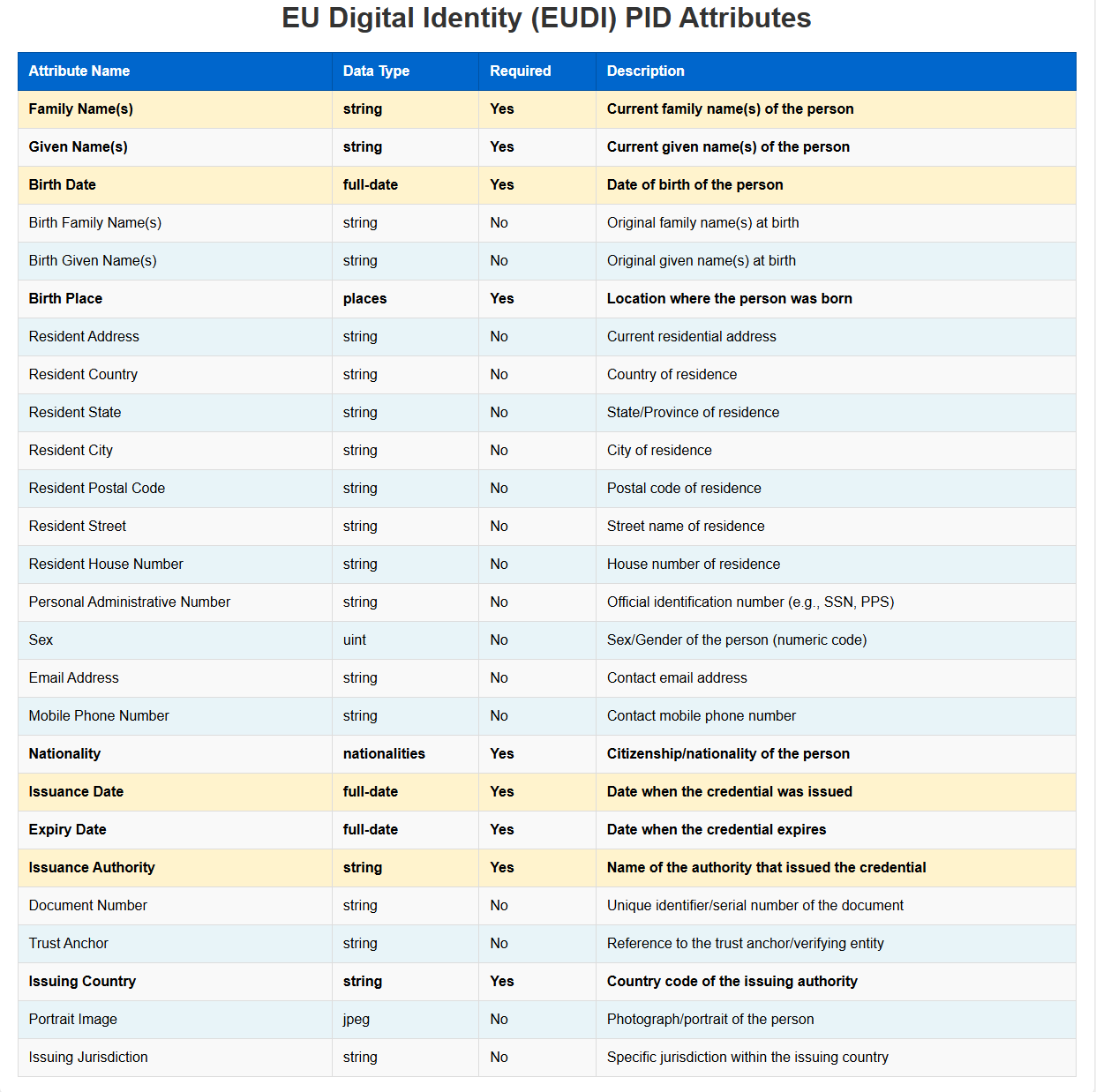

The EUDI Framework uses a "Data Minimization" approach. You only share what is strictly necessary. The attributes are divided into Mandatory and Optional sets.

PID Credential Attributes

very PID across the EU must contain these attributes to ensure cross-border interoperability:

PID vs. EAAs vs QEAA : The Trust Anchor

It is vital to distinguish between your Identity (PID) and your Claims (EAAs).

How they work together:

In the EUDI architecture, your EAAs are cryptographically bound to your PID. When you present a digital diploma, the Verifier doesn't just see the degree; they receive cryptographic proof that the degree belongs to the specific person identified by the state-issued PID in that same wallet.

The integration of Person Identification Data (PID) into the EUDI Wallet is not just a digital upgrade, it is a complete overhaul of the Know Your Customer (KYC). By 2026, regulated businesses (Banks, Telecoms, and Insurers) must be ready for a shift from "scanning" to "verifying."

1. From "Selfie Checks" to Instant Cryptographic Proof

Today’s remote onboarding is friction-heavy. Users take photos of plastic IDs, perform "liveness" selfies, and wait for OCR (Optical Character Recognition) to extract data. This process is prone to errors, lighting issues, and a high abandonment rate.

The 2026 Shift: Onboarding moves from an optical scan to a direct cryptographic exchange.

2. Defeating AI-Generated Fraud

Traditional KYC is struggling against Synthetic Identity Fraud and AI Deepfakes. Criminals can now use AI to manipulate a photo of a passport or bypass a selfie check with a digital mask.

The 2026 Shift: PID is built on Public Key Infrastructure (PKI).

3. Lowering the "Cost Per Acquisition" (CPA)

Manual review is the "hidden killer" of business margins. When an OCR tool fails to read a blurred ID card, a human agent must intervene, driving up costs and slowing down the customer.

The 2026 Shift: PID provides structured, machine-readable data.

4. Privacy-First Compliance: Selective Disclosure

The biggest paradigm shift is moving from over-sharing to data minimization. Under current rules, to prove you are an adult, you hand over your entire ID—revealing your name, address, and exact birth date.

The 2026 Shift: The EUDI Wallet introduces Selective Disclosure (via the SD-JWT and mDoc formats).

While the benefits are clear, the road to 2027 is paved with technical hurdles.

Integration complexity

Banks and businesses cannot simply "switch on" EUDI acceptance. They need to update their tech stacks to communicate with the wallet infrastructure. This involves building the capability to verify the cryptographic signatures associated with PID and ensuring their systems can consume this new data format.

Cross-border interoperability

The promise of the EUDI Wallet is that it works everywhere. However, ensuring a digital wallet from Spain interacts seamlessly with a KYC process in Poland is a massive technical challenge. The Architecture and Reference Framework (ARF) provides the standards, but implementation will vary across member states.

The transitional period

Adoption will not happen overnight. Even after the 2026 mandate, not every citizen will have a wallet immediately. Businesses will need to run hybrid systems accepting both traditional ID checks and EUDI Wallet PID for several years. This will add operational complexity during the transition.

Waiting until late 2027 to think about PID is a risky strategy. Here is how compliance officers and product managers can prepare today.

Audit current KYC flows

Map your current data intake. Identify exactly where manual entry or document scanning occurs and where PID could replace these steps. Determine which specific data fields you currently mandate and match them against standard PID attributes.

Engage with Trust Service Providers

Most businesses will not build their own wallet connectors from scratch. Start conversations with identity verification vendors and Qualified Trust Service Providers (QTSPs) who are already building infrastructure for the EUDI Wallet. Ask them about their roadmap for PID support.

Monitor technical standards

Keep an eye on the evolving standards within the ARF. The technical specifications for how PID is presented and verified are being refined. Staying informed ensures your technical team isn't blindsided by protocol changes.

Is PID mandatory for all EU citizens?

Member states will be required to offer a digital wallet to every citizen across the region, but they are not mandated to use it. However, the convenience of the wallet is expected to drive high adoption rates.

Can PID be used for Anti-Money Laundering (AML) checks?

Yes. Because PID provides high-assurance identification of the customer, it satisfies the core requirement of customer identification within AML directives. However, businesses will still need to perform separate checks for sanctions and politically exposed persons (PEPs).

Who issues the PID?

The PID is issued by the Member State (the government) or by a body mandated by the Member State. This government backing is what gives PID its legal weight.

The introduction of PID within the EU Digital Identity Wallet represents the modernization of trust in Europe. It moves identity verification away from the physical limitations of plastic cards and into a secure, digital-first future.

For businesses, PID offers a path to faster onboarding, reduced fraud, and lower costs. However, realizing these benefits requires proactive preparation. 2026 may seem distant, but for complex compliance ecosystems, it is right around the corner. Start assessing your readiness now to ensure you are not left behind when the digital wallet becomes the new standard.